Inflation Investigation (Part 1)

Intro to Inflation and Why Common Leading Indicators Aren't Always Reliable

Introduction

After a 40-year hibernation, inflation is coming. Or is it? Are we turning Japanese or on our way to resembling the Weimar Republic?

With the massive amount of fiscal and monetary stimulus being injected since 2009 (and intensifying since COVID began), there have been concerns about an overheating economy that would rear its ugly head in the form of inflation. So far the perception of potential inflation has not materialized in reported numbers, namely the Consumer Price Index (CPI). However, a combination of the Fed signaling a willingness to overshoot their 2% inflation target and some spiking leading indicators suggest to us that this time could be different. If it is, it could have profound effects on the equity market.

For instance, many of the stocks that have led this secular bull market from 2009 on have relied on the endless cheap capital (perennial cash burners) with near 0% interest rates and could soon have to pay more for said capital. If rising inflation expectations lead to rising long term interest rates, it materially impacts “long duration equities”--companies whose intrinsic value is dominated by future cash flows (say a money-losing SaaS software company). This is just Finance 101: those hypothetical distant cash flows will have to be discounted at a higher rate bringing the present value down.

In this article, we cover some basics on inflation from a generalist viewpoint (what it is, what drives it, etc.). And in an effort to calibrate how history may rhyme this time, we will compare and contrast to two contradictory case studies in subsequent articles: the Weimar Republic hyperinflation (as Michael Burry has warned we are headed towards) and Japan, which has seen large stimulus over the past thirty years but has consistently missed their 2% inflation target.

Although we are stock pickers at heart, we feel keeping a beat on potential Black Swans, or the potential of that sentiment developing, is worthwhile. As is exploring whatever macro theme/worry is currently front of mind for investors.

Our conclusion is that heightened inflation is unlikely to get to the point Burry has outlined. There are real reasons to believe the US will be different from Japan and Western Europe but elevated inflation from what we have seen in the last 40 years is a very real possibility, particularly if recently proposed fiscal stimulus were to occur. It will be important to monitor loan growth, savings rates, and government spending levels that can collectively create higher money velocity and drive inflation.

Intro to Inflation

Inflation broadly is the change in prices of goods and services. More specifically and in our context, inflation can be defined by the aggregate changes in the monetary base (hello, Federal Reserve) combined with the velocity of money (essentially, cash turnover). In the United States, the de facto measure of inflation is the Consumer Price Index (CPI).

The CPI is an index that is based to 1982-1984, so that the index starts at 100 in the 82-84 average base, and then moves higher (lower) to measure inflation (deflation). So the CPI index will be effectively comparing various goods and how they were priced in 1984 to how they are priced currently, to produce an index. The way the CPI is measured is the Bureau of Labor Statistics (BLS) takes a basket of goods and services, assigns weights to them to approximate the spending of an average consumer, and then tries to see what the same goods cost in US dollars at different points in time. The BLS weights as of February 2021:

One important distinction is what is highlighted in blue, Food and Energy. While obviously very important, these are often excluded from “core” inflation, which is stickier/more stable, while “headline” inflation includes everything.

As we can see below, over the long run there is not a large difference, but because energy and food can be volatile, quarter to quarter and even year to year there can be some appreciable differences (e.g. 1986, 2007/2008, 2014):

Looking at the chart, you can see we have enjoyed a remarkably low inflation rate for several decades now. In fact, last month’s 1.3% core inflation was the lowest since 2010. However, we have also had two decades where the average monthly inflation was above 6%:

Note that although the 1980s are skewed by 1980-1982 (although core was still in the 4-6% range for most of the decade), we are still talking about at least a decade where inflation was triple what it has been the last twenty years or so. We do not believe most analysts nowadays have ever really seen anything more than benign inflation, so even if we are not headed to hyperinflation, it’s worth taking note of and envisioning what 5-6% inflation might look and feel like.

What Drives Inflation?

Given the stupendous levels of effective money printing by various developed country central banks (Japan, Europe, and the United States being most notable), one would think that inflation would seem almost inevitable. After all, if more dollars enter the economic system, doesn’t that mathematically mean every existing dollar should be worth a little less, and hence goods should cost more dollars?

Yet that does not happen. There must be some kind of “cost-push” or “demand-pull” dynamic for inflation to materialize. In fact, if you juxtapose the money supply (M2) with the Consumer Price index, it often looks negatively correlated. To put an extreme example out there to illustrate this, we will steal from an article from Michael Lebowitz we found informative:

“We consider two extreme examples of money printing and monetary velocity…

1) The Fed Prints $10 trillion and buries it in a hole.

2) The Fed Prints $10 trillion, and sends each American a $30,000 check, and tells them they have five days to spend it or lose it.

The two examples have polar opposite effects on price…In example 1, the Fed does not affect inflation…In example 2, hyperinflation would result as the new money rapidly circulates through the economy and dwarfs the economic system’s production capacity.”

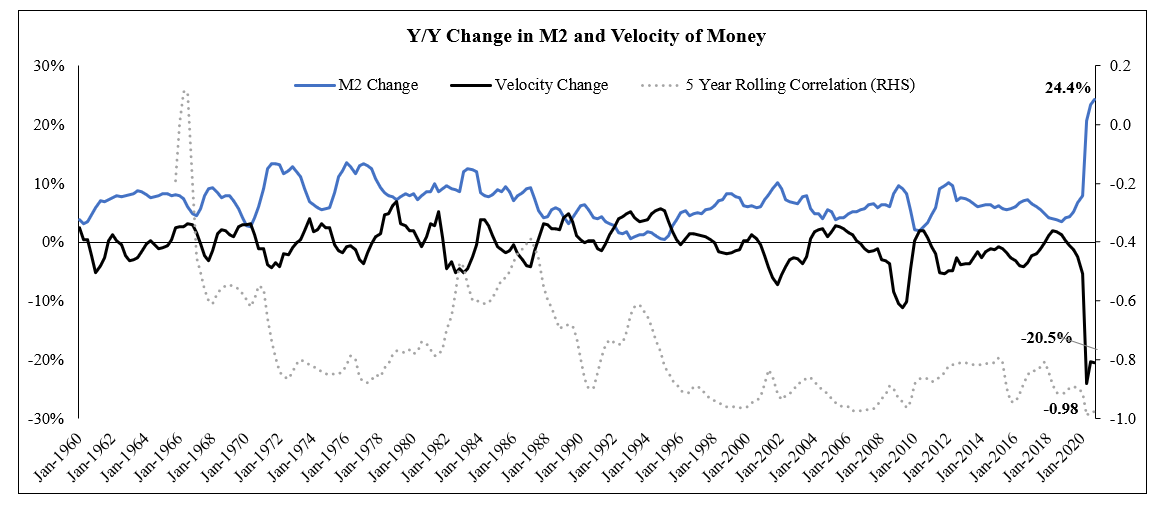

Lebowitz argues that inflation is an equation, whereby inflation % = rate of money growth (change in M2), plus the change in money velocity, less the rate of output growth, where velocity is = nominal GDP divided by the monetary base. Simplifying this by removing GDP, he notes that “inflation is dependent on money supply and velocity changes.”

Historically, the change in money supply and the change in velocity have been negatively correlated and you can see recently that the correlation has been basically -1, with massive recent movement in both M2 and velocity:

So right now the recent massive injection of money (both from the Federal Reserve and the US Government) is acting more like the extreme first case, where the Fed prints $10 trillion and buries it in a hole. What will drive inflation is getting the money sitting there “doing nothing” to do something. This would include people lowering their savings rates, more loans being made, and having the US Treasury spend some of the cash on its balance sheet.

Amazingly enough, as Lebowitz points out, the government itself is part of the problem as about $1.6 trillion of the $3 trillion the Federal Reserve printed was still sitting as a deposit on the US Treasury Cash Balance as recently as late February:

Similarly, US savings rates skyrocketed with COVID and are currently at 13%:

As “excess” savings are spent, which seems to be happening, the velocity of money could meaningfully accelerate and drive inflation higher.

Inflation Expectations

While there are many ways to gauge inflation expectations, we would highlight a few measures to suggest that we are at a unique period of time that could possibly be an inflection towards “higher for longer” inflation, or at least the expectation of such.

First, we would point out that collectively we have “inflation on the brain,” as Arbor Data Science notes, with Google Search history spiking for inflation and inflation like terms, and the net difference between inflation searches and deflation searches hitting an all-time high per Google searches.

Second, commodity prices have been soaring, led by energy, which could imply a more robust demand environment that could stimulate inflation.

Third, surveys show accelerating inflation expectations. The University of Michigan 12-month inflation expectation survey is now running at its highest point (3.3%) since briefly touching 3.3% in 2014, and the ISM prices paid survey is in the 98th percentile.

Finally, and perhaps most cited, we can look at the 5- or 10-year breakeven inflation rate, as is implied by comparing the yields of 5-year treasuries and 5-year Treasury Inflation-Protected Securities (TIPS).

If the 5-year treasury is yielding 1%, and TIPs are at -1%, the implied inflation breakeven, and hence the expected 5-year inflation level, would be 2% (1% minus negative 1%). Here is that spread going back over 10 years:

You can see that this has never been higher since 2009, although it did approach current levels in 2010-2011. Keep in mind that there could be some distortion to this breakeven rate, as the Fed has been buying TIPs, which could exacerbate the spread.

We would point out that many of these leading indicators have not been great in predicting the subsequent emergence of actual inflation--or stated more accurately, cannot predict magnitude very well.

For instance, if we overlay the University of Michigan’s 12-month inflation survey data with realized inflation 12 months later, we can see that in the 1970s and 1980s it materially underestimated actual inflation, but has since been consistently overestimating actual inflation:

Similarly, studies examining whether commodity price changes are a leading indicator to inflation were indeed a harbinger of rising core inflation in the 1970s and 1980s but have been weak at predicting inflation since. A study by Fred Furlong and Robert Ingenito notes that:

“the results indicate that the empirical link between commodity prices and inflation has changed dramatically over time, largely because of the changes in the extent to which movements in commodity prices reflect idiosyncratic shocks.”

In other words, the rise in commodity prices were more based on outlier events that did not represent the underlying trends of the economy.

Thus we’re left with several leading indicators of inflation all pointing upwards, some of which were predictive in the 1970s and 1980s, but overall have not been predictive of inflation over the last thirty years.

In the next two parts of this series we will evaluate two extreme outcomes from history that have been predicted for the United States: the Japanese experience of multi-decade low inflation and Weimar Republic-like hyperinflation.