While the market has been focused on GPU chips and AI scripts, our attention has been on cement blocks and crushed rocks. We've enthusiastically made CRH one of our largest positions ever at cost due to what we believe is very limited downside for a best-in-class operator with multi-year earnings growth visibility. CRH is among the largest aggregates and infrastructure companies in the United States and Europe and recently relisted to the NYSE from the LSE, which we believe will be a catalyst for a re-rating upwards towards peer valuations as the stock represents undeniable value hiding in plain sight.

Company Overview

In 1970, Cement Limited and Roadstone Limited, two Irish infrastructure-focused companies, combined to form Cement and Roadstone Holdings, or "CRH.” An investment of $1 million into CRH upon its founding 53 years ago would have turned into $1.5 billion by mid-year 2023, an annualized total return to investors of 15.0%, a high rate of compounding we think can continue.

Half a century of success at CRH has been driven by disciplined operations and capital allocation that we believe derives from a company culture built around appropriate financial incentives. CRH’s M&A playbook has proven to be successful as an acquisitive company like CRH can't compound at a rate of 15% over 50 years unless acquisitions and divestitures have been executed at attractive prices. Over the last five years, CRH has spent $10.3 billion on acquisitions while receiving $10.5 billion in proceeds from divestitures across dozens of transactions, with the average acquisition multiple ranging from 7x – 8x EBITDA and the average exit multiple clocking in at 11x EBITDA.

The Company reports under four segments split by geograhy and product category: Europe Materials, Europe Building Solutions, North America Materials, and North America Building Solutions.

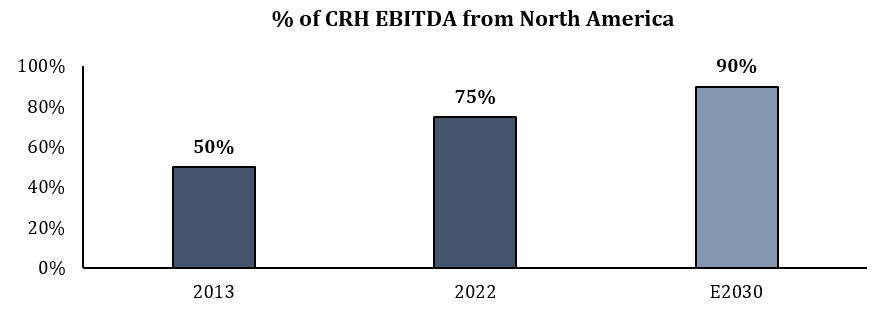

Approximately 75% of EBITDA is generated from the North American divisions (10% higher than the average S&P 500 company) with the company guiding for this to rise to 90% by the end of the decade.

Infrastructure represents the largest end market for CRH at 40% of revenue and Repair, Maintenance and Improvement accounts for just over half of end market use.

Materials

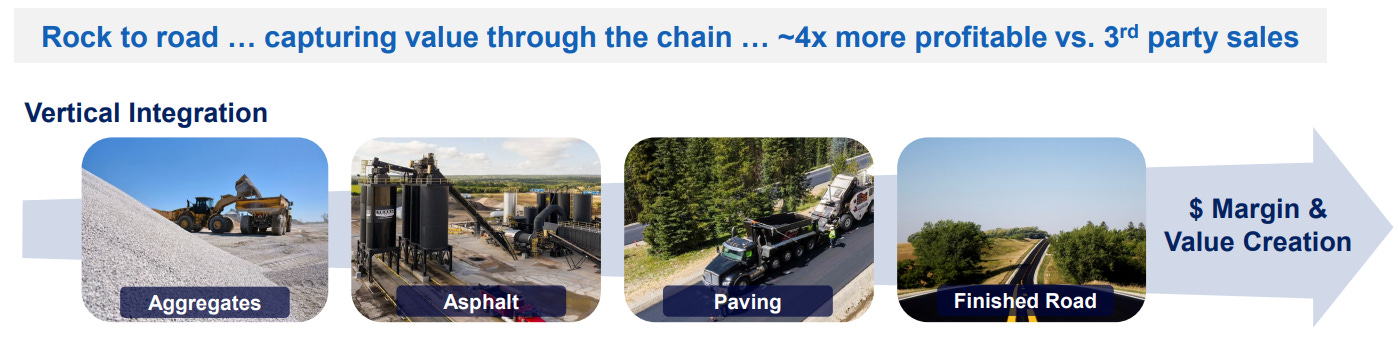

The Materials segments are vertically integrated as CRH produces and supplies aggregates, cement, ready-mix concrete, and asphalt, as well as providing related services such as road paving.

The aggregates business in particular has terrific economics as most operate as local oligopolies or monopolies. If you are a user of aggregates, you will almost certainly use quarry closest to your project given the costs to transport are so high. Given this dynamic, the industry has historically enjoyed stable annual pricing increases and over the last 52 years, aggregates annual pricing has only dropped in three of those years (and only -1.5% on average). CRH is sitting pretty with the largest aggregates mineral reserves in North America at 19 billion tons – comfortably more than Martin Marietta (17 billion tons) and Vulcan Materials (16 billion tons).

On the cement side of the business, industry dynamics are much like Greg Focker’s portfolio—strong to quite strong - and CRH has about 11% market share across its 12 plants in North America. It is very difficult to add cement capacity in the United States because of stringent environmental regulations so the domestically produced supply is maxed out at around 100M metric tons per year. At the same time, even with depressed residential development as of late, US demand is currently running at ~120M metric tons per year. Excess demand is supplied by imports, which come at a significantly higher cost than domestically supplied cement. To state the obvious, this supply/demand dynamic has been very favorable for cement pricing, a trend we see continuing.

CRH is also among the largest asphalt manufacturing and paving companies in the United States and has clear advantages of scale that help the Company produce best-in-class margins on its product. Bitumen is a key component in producing asphalt and due to CRH's massive size, they have a "winter-fill" program that allows the Company to acquire bitumen cheaply in the winter months and store it for use during warmer construction months. Smaller competitors lack access to the kind of infrastructure needed to do this.

Building Solutions

The Building Solutions segments manufacture and supply outdoor products such as hardscapes, fencing, railing, masonry, packaged products, lawn and garden, pool finishes, and composite decking, in addition to concrete infrastructure, precast products, drainage systems, water management, and other construction components.

The first subsegment of Building Solutions is the Outdoor Living business. This business has one of the broadest offerings of products for public and private outdoor spaces including Pebble Tech pool finishes, MoistureShield composite decking, Barrette railing and fencing, and Belgard paver stones and outdoor kitchens. If you have recently remodeled your backyard, it is highly probable that you’ve installed at least one of their products.

The other subsegment of the Building Solutions segment is the Building & Infrastructure business. This business provides critical infrastructure for connecting, protecting, and transporting water, energy, and telecommunications infrastructure. This segment thrives on large complex projects.

The key differentiator for CRH is its vertical integration. Materials produced in the upstream aggregates and cement business are supplied as components to downstream businesses like asphalt and ready-mix concrete.

This integration between the Materials business and the Building Solutions business provides customers with end-to-end solutions whereby they only must deal with one vendor instead of multiple. This helps projects get completed on time and on budget. CRH can construct components off-site and deliver them on an as needed basis, reducing labor on-site and idle time from unorganized logistics scheduling between disparate third party vendors.and as mentioned, is fully integrated with the upstream Materials business. CRH is heavily involved early in a project's lifecycle, beginning with the design phase, and they develop customized solutions given their expertise and broad capabilities.

US Infrastructure Tailwinds

As one of the largest building materials businesses in North America, CRH may be the single largest beneficiary of the recent unprecedented government infrastructure spending programs, including the Infrastructure Investment and Jobs Act (IIJA), CHIPS and Science Act (CHIPS), and the Inflation Reduction Act (IRA). For instance, of the $1.2 trillion in IIJA funds, about $350B is allocated to Highway funding, and CRH is the #1 road paver in the U.S. Throughout the 5- year life of the spending bill, it is estimated that annual federal spending on highways will increase by 50% above the baseline 2021 spend from $47 billion per year to north of $70B per year. The IIJA has been touted as the most transformative public investment program since the 1930's.

Perhaps equally as important as the IIJA spending is the onshoring of manufacturing that is occurring in the United States, with the support of the CHIPS and IRA. This has led to $200B+ of major commercial projects that have already been announced to bring critical manufacturing back to the US. These "mega projects" are squarely in the sweet spot for CRH, and they offer significant visibility for the infrastructure business through 2030. The Company has quantified the expected increase in annual manufacturing-related spending in the US as 2.5x higher than previous levels.

Below are estimates from TRG Research on the combined increase in annual spend across the 3 major bills by vertical.

Additionally, many of CRH's top markets are benefiting from ongoing interstate migration and strong job growth, with three of CRH's top states ranking among the top four in terms of employment growth since 2019. Not only will strong local economies help to keep state budgets flush at their current record levels, but this growth necessitates increased infrastructure investment, and a significant piece of IIJA funding will go to these states.

Q3 2023 Comments from Competitors

We can also look to recent commentary on Q3 earnings calls from CRH comps to get a sense for what the public infrastructure side is looking like heading into 2024.

Vulcan Materials

“On the public side, leading indicators remain supportive of continued growth in both highway and infrastructure. Trailing 12-month highway starts are up 18%, and 2024 state budgets are at record levels. We continue to expect accelerating growth in public construction activity into next year and continued growth for the next several years.”

Summit Materials:

“ Let's start first with what we know, and that is 2024 is setting up to be another strong year for pricing.”

“ For public [end markets]… our leading indicators for future activity are flashing green. Fiscal 2024 DOT budgets for our top five public states are up 14%, lettings on a trailing 12-month basis are up nearly 26%… our public backlogs in key markets are nearly double prior year, as demand is robust and accelerating for infrastructure projects.”

“I always use Texas as our bellwether state on how we're doing on backlogs. They're nearly double what we had last year and they're building. So bottom line for all that data I gave you was public [infrastructure] is very strong. We continue to see that into 2024.”

Martin Marietta

“The value of state and local government highway, bridge and tunnel contract awards a leading indicator for our future product demand is meaningfully higher year-over-year. These infrastructure contract awards grew 18% to a record $114 billion for the 12-month period ending September 30, 2022"

Relisting

As noted above, CRH completed a relisting to the US on September 25th and now maintains a primary listing on the NYSE, with a secondary listing on the London Stock Exchange. This relisting will entice more investors over the coming year to rerate the stock much closer to US peer valuations rather than languishing at European peer valuations. Once the sell side and US-based investors grow familiar with the name, we believe the inexplicable valuation gap will be too hard to ignore and the market will do its job of appropriately valuing CRH as the best-of-breed operator within an advantageous industry.

In addition to increased investor awareness, the Company has cited increased business opportunities as CRH will appeal more to customers who favor dealing with US-based companies, not the least of which are state and local governments. It will also provide better opportunities on the M&A side through better visibility and a strong currency in US company stock for potential acquirees.

CRH aims to being well represented in US-based indices and once the Company files its 2023 10-K around March 2024, it will be eligible to be included in the S&P 500, which provides another major catalyst from passive flows and index-constrained active managers alike. As of Q2 2023, prior to the re-listing, CRH’s ownership base included a fraction of the amount of U.S. insitutions and funds relative to U.S. listed comps.

Valuation

We believe the current valuation of CRH provides for limited downside and is significantly cheaper than peers despite being a best-in-class operator across all the business segments the Company competes in. CRH trades at an 11.5x P/E based on the '24 consensus and 7.0x EV/EBITDA (6.4x our estimate). As shown below, the most relevant peers are trading around 10x - 15x 2024 EV/EBITDA and around 18x - 28x on an earnings basis.

CRH currently trades at this significant discount despite having much lower leverage as well as better cash flow conversion and higher ROIC than the materials only pure plays given CRH’s vertically integrated business model.

It is also worth highlighting the fact that the Company has provided guidance for $35B of cash generation over the next five years, an amount equal to >90% of the Company's current market cap. We estimate this is comprised of $25B of FCF generation and $10B from re-levering the balance sheet from 0.8x net debt/EBITDA to about ~2.0x.

Our price target, based on our 2025 estimates, uses a 10.3x EV/EBITDA multiple, which implies a ~20x P/E multiple. This equates to a ~$120 per share value (including dividends received), which is ~118% above the current price of $55.

These assumptions are conservative relative to historical comparable company valuations of around 20x – 30x NTM P/E.

We think US investors will soon recognize that a company with this level of stability, cash flow generation, capital allocation track record, and robust earnings growth visibility is a value too great to ignore at 11.0x earnings.

Disclaimer: https://www.vosscap.com/disclaimer

Not convinced them leaving London will create more value for shareholders in the long term, but only time will tell

Good writing, thanks for sharing!