Software Siphon

An Updated Look at Stock Comp in Software

In July 2022 we wrote an article titled “Stock Comp in Software: Hidden Margin Deterioration?” in which we made the case that stock based compensation (SBC) had become meaningfully more pronounced in public companies and that software margins were effectively (and significantly) lower than they were through the 2000s and 2010s.

In assessing how attractive the industry was, we pointed out that at that time, growth expectations were significantly higher than average, above 20%. As we look at our dataset now, things have changed materially and we make the following arguments in this post:

SBC as a percent of revnue remains historically high.

“True” Rule of 40 (Adjusted EBITDA margin - SBC margin + expected NTM revenue growth) is down across the board.

Revenue growth has deteriorated while margins have not rebounded sufficiently to make up for the growth slowdown.

Smaller companies (under $1 billion in revenue) are showing the worst of the deterioration in “true” Rule of 40 while the very largest companies are not as impacted yet. This may explain the recent dominance of the few mega cap software stocks as the fundamentals at least partially justify outperformance.

Despite large declines in 2022, software stocks still seem very expensive versus almost any other point in history.

A Brief Historical Note on Stock Based Compensation (SBC)

We won’t belabor and bore you with the nuances of SBC accounting here but we did want to point out one interesting item we uncovered as we attempted to build a credible dataset back to 1998. One reason it is hard to normalize SBC for companies, specifically before 2006, is that prior to that year companies generally utilized what they called the “intrinsic value” method of expensing SBC. As noted by Oracle in their 2006 10-K, “We generally did not recognize any compensation expense for stock options as the exercise price of our options was equivalent to the market price of our common stock on the date of the grant.” This is the intrinsic method --intrinsically, at that moment, the option doesn’t have any value. At the time SBC was almost all options, not restricted stock units (RSUs), so the intrinsic value was generally zero. Although no expense was recognized on the income statement utilizing this method, companies were required to report a “pro forma net income” that estimated a fair value of SBC under the more familiar Black-Scholes model. For instance, if you look at Oracle’s 2002 10-K, you can calculate what SBC was by subtracting their GAAP net income from their pro forma net income:

For those interested in learning more about fair value versus intrinsic value of SBC, the relevant guideline (Standard No. 123, Revised) from the FASB is linked here.

Our overall observation of this is that software companies had an even bigger racket going on then than they do now. We can’t conclusively verify this, but we believe what ultimately kicked off the concept of “Adjusted EBITDA” was tech companies effectively pouting, “we weren’t recognizing SBC before and we refuse to now, so here is a new metric to get around that requirement.”

With all that in mind, we were able to construct the median SBC as a percentage of revenue going all the way back to 1998 (through May 30, 2023):

This chart was interesting to us because we didn’t have a good sense of just how much the price action of stocks was accelerating the stock comp expense rates, versus companies just handing out more shares to employees. You can see that during the 2000 Tech Bubble, SBC did grow substantially, which we believe was primarily fueled by stock price appreciation. One thing to point out, though, is that a much larger percentage of SBC today is RSUs, which don’t have the same kind of expense leverage that options do. In other words, appreciation/depreciation in stock price in today’s environment may impact SBC less than it did back in the Tech Bubble. Also notable is that we have not really seen SBC as a percentage of revenue decline yet despite a major sell off in software stocks, which means software companies are diluting existing shareholders at an even greater rate now.

For the rest of this article, we will use Next Twelve Months (NTM) data for revenue and EBITDA.

Rule of 40 is Down Across the Board

You can see below that if you use Adjusted EBITDA and revenue growth to build a Rule of 40 score, currently the median software stock is on the lower end of its 15-year range, but certainly still within a longer term trend (although down from a year ago). However, if you factor in SBC, Rule of 40 is closer to Rule of 20 for the average software stock, and the gap between Adjusted EBITDA and what we call “True EBITDA” (adj. EBITDA less SBC) has almost never been higher:

Revenue Growth is Driving the Recent Deterioration in Rule of 40

When we wrote our article last year, expected growth was still above 20% but over the past year growth expectations have come down significantly for software stocks, and just recently broke below their long-term average growth of 16%:

15% is of note because in periods when growth is above 15%, the median EV/NTM Sales ratio has averaged nearly 5x. When growth is below 15%, it has averaged closer to 3x. Currently the median is 4.5x.

On the other hand, EBITDA margin expectations have recently improved, both on an Adjusted and “True” basis, just not enough to compensate for the decline in growth. Below you can see that since our last update, margin expectations have improved at the median by 300-400 bps. Companies are reacting to this lower growth environment, just (arguably) not enough:

Scale Considerations

To be clear, there are significant differences in how much or little fundamental deterioration has occurred. If we bucket software companies into four tiers of revenue base, and compare 2015 to present day, you can see there has been True EBITDA margin improvement for the largest cohort (>$10 billion in revenue), while every other group has experienced significant margin degradation:

Doing the same exercise but adding in revenue growth to produce a Rule of 40, we can see the biggest of the big have 55% Rule of 40 scores even after accounting for SBC, which is an improvement and near a new high since 2015. Meanwhile, very large companies ($1-$10 billion) have only seen modest declines in Rule of 40 while the real drop has occurred in the smaller companies:

The collapse in software stock prices since early 2022 has been harsh on all size cohorts, but given this context, it makes it somewhat easier to swallow that the largest companies (MSFT, ORCL, etc.) have appreciated the most YTD in 2023 and breadth has become miserable.

EBITDA Multiples

Looking at companies with revenue bases greater than $1 billion, which in our minds should have significant operating scale, EV/NTM EBITDA multiples are still highly elevated relative to history with or without stock based comp added back. As you can see below, these supposedly “scaled” companies are still trading at 36x NTM EBITDA despite growth expectations imploding. Indeed, from 2008-2016, the median software stock traded in a tight valuation range of 8-12x EBITDA, with or without SBC. Even if we don’t apply any penalty to SBC, we are still nearly double that today:

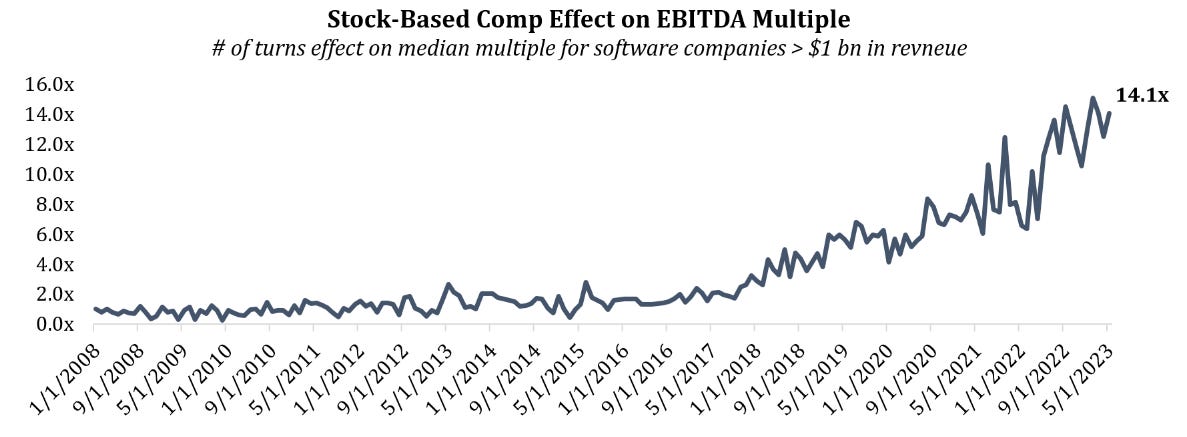

Another way to perhaps visualize how SBC has made software companies implicitly more and more expensive is to show how many EBITDA multiple turns more expensive the median stock is without SBC.

Again, this is only for software companies with greater than $1 billion in revenue (currently there are 58 of them).

Conclusion

Software in aggregate continues to look expensive in a historical context when comparing growth and profitability (Rule of 40) to valuation, specifically when factoring in SBC and overwhelmingly when removing the largest of the large, whose fundamentals have held up well. While our general thinking is that software as an industry now has higher quality recurring revenue and is more resilient to recession, and thus potentially deserving of a higher than historical average multiple, the steep decline in growth expectations with only modest margin improvements causes us to remain quite cautious on the space in general. We are, however, still finding plenty of attractively valued bottom-up opportunities within vertical niche SaaS stocks.

A concern we have is that the amount of VC money and the sheer number of companies now out there competing, along with the cloud lowering switching costs, will make the 40%+ margins many people assume are possible for software companies quite challenging (unless you have giant scale and a real moat like Microsoft). Combine that with much higher interest rates and it’s not inconceivable to us that stocks could drop back closer to 3x sales at the median.

Furthermore, AI is still in its infancy and while we believe there are reasons it could be a tailwind for margins (eliminating the need for certain coders, more rapid innovation), there are also reasons to be concerned that AI could create a more commoditized product over time and could endanger certain companies (low code/no code, call centers, etc.).

Note on Methodology

In our previous article we were using Factet’s Packaged Software nomenclature, running it through their Alpha Tester product to ensure point-in-time accuracy. Since then, we have begun sourcing our data from Refinitiv’s database platform (using IBES forward estimates), which we believe have better classifications and more robust data. In this case, our universe includes: all stocks whose industry is labeled as “software” at the point in time we were reviewing it, not be an ADR, trade on a U.S. or Canadian exchange, have forward sales estimates, and have a market cap >$250 million.

Great article. Common theme I hear is that a lot of tech companies aren't necessarily generating "true" profits given a certain level of EBITDA but an even greater SBC expense. I'd be interested in hearing whether your team incorporates future equity dilution from SBC issuance into the valuation methodology for names with a longer holding period.