The Big Long? A Deep Dive on U.S. Housing (Part 4)

Part 4 – What Slow Down? Recent Commentary from Builders and Building Product Companies

As we have followed US housing closely for many years and analyzed the abundance of data available on the industry, we have shared a series of articles that have attempted to add much needed context and nuanced analysis to the conversation. It has been clear that negatively slanted articles are getting anywhere from 10-100x the engagement on social media despite, or perhaps because, the arguments are overly simplified and everyone is still so scarred from the GFC housing bust. For many months and quarters (even years) now, people have been quick to share headlines calling for a bubble set to burst in the U.S. housing market with some repeatedly calling for a crash worse then 2006 - 2009 and the bearishness seems to have reached a fevered hysteria as of late.

While these types of headlines and posts no doubt generate clicks, it conflicts not only with our own assessment of the data but also with what the actual operators within the housing ecosystem have been saying. As such, this week we wanted to let the words of the business operators speak for themselves.

Below is a compilation of recent quotes from the management teams of homebuilders and other housing-related businesses over the past few weeks.

Century Communities – April 27th, 2022

"The elevated interest rate environment has not eliminated the demand drivers propelling the housing market over the last several years, including the ongoing shortage of both new and resale homes available for purchase, millions of millennials, the largest generational group in the country, reaching the prime age for new household formation and the increased desire for homeownership brought about by the pandemic.”

“The amount of traffic that we are getting and the amount of demand that we're seeing far exceeds the supply of homes that we have available."

"We're continuing to be able to sell our homes before they're complete. And if we start seeing that changes in the market, then we'll adjust how we market, sell and price our homes. But we've not reached that point yet."

"We've really seen no pushback on pricing. As we said in our prepared remarks, each month during the quarter, the sales actually increased. And throughout the quarter, we continue to raise pricing. And we have not seen any push back from that. Now at some point, that's going to stop... But at this point, everything remains very positive."

Taylor Morrison Homes – April 27th, 2022

"From a demand perspective, activity was healthy, and shoppers were engaged across our markets and consumer groups in the first quarter. We raised based house prices in effectively all of our communities… The positive sales momentum has continued thus far into April, and our sales teams across the country continue to report that activity overall remains resilient."

“Below-average cancellation rates, which were among all-time lows at approximately 6% last quarter.”

“Of our borrowers in backlog, average credit scores are among all-time highs at 752, and average down payments of 24% are higher than a year ago on a larger loan amount."

“Looking at first quarter closings, we estimate our conventional borrowers could have qualified at an interest rate nearly 650 basis points higher than their actual rate. This strength extends into our backlog where the 82% of borrowers qualify for conventional loan have similarly strong financial positions to absorb higher rates before adjusting loan terms or other offsets.”

“Only a single-digit percentage of all respondents (in a survey of 1,500 home buyers) said they would stop their home search if affordability became a constraint, instead opting to modify their plans either by reducing square footage, increasing their down payment or slowing down their search. This is quite different from what surveys indicated as rates increased in 2018 when shoppers were twice as likely to say they would stop their home search at that time, suggesting current demand is much more determined to move ahead.”

“we're seeing really robust demand in all consumer sets through the quarter. And no real difference in April... there's no trends that are worthy of kind of speaking to. It's generally pretty good across the board.”

Tri Pointe Homes – April 21st, 2022

“Demand continued to remain robust in all of our markets in the first quarter even as mortgage rates have moved materially higher. The homebuyers in our backlog are well qualified and are prequalified through our mortgage affiliate prior to purchasing a home. They have an average debt-to-income ratio of 39% and an average FICO score of 749, an average loan-to-value of 82% and average annual household income of $189,000. The majority of our homebuyers are millennials, and this cohort continues to be a strong source of demand for the industry, driven by needs based, life-changing events such as marriage, a growing family or a job relocation."

“This sizable population of buyers is in the prime home buying phase of their lives, and the homebuilding industry stands to benefit from their participation in the markets for years to come.”

“This supply-demand imbalance for both new and existing homes will persist for some time, providing the new home industry with a healthy fundamental backdrop for the foreseeable future."

"The biggest thing they say also is the supply. I mean everybody wants to compare to prior year cycles, but there is just no supply… go back to 2018… we had a lot more supply. The resale market was much greater…There [was] a lot of product available. Mortgage rates got into the low 5%, 5.5% range back in those days… it really tampered - kind of pulled back demand. So, all these cycles we go through are different. I continue to believe on a macro basis that there's more demand in this millennial group that we're still just tapping into, and there's just no supply."

M/I Home – April 27th, 2022

"The quality of our buyers continues to be very strong with average credit scores of 747 and average down payments above 16%. Basically, the quality of buyers that we're seeing in terms of creditworthiness is the best we've ever seen."

“Demand has held up considerably better than I think many of us would have predicted. If like I said earlier, if we were told 60 days ago, rates are going to be 5.5%, what will happen to, demand. I think a lot of people would not have predicted that it would still be as strong as it is, notwithstanding the historically low levels of inventory. And I think the historically low levels of inventory remain a very important metric that is helping to drive demand… millennials continue to move from renting to owning and are getting closer to maybe about where they should be as a home ownership rate, still below, I think, some of the previous generations. And the Gen Zs are beginning to jump into the pool. So that's a good thing, too."

Meritage Homes – April 28th, 2022

“Demand is still healthy today. In addition to early month sellouts from January to April, our cancellation rate of 9.6% this quarter is similar to the last 8 quarters and low compared to our historical levels and what is typically expected for entry-level products. The credit profile of our homebuyers remain stable and consistent at historical average of high 30s for DTIs and high 730 for FICO scores.”

“Entry-level comprised 83% of quarterly orders, up from 76% in the first quarter last year.”

“All the leading indicators around traffic and web activity, contact center activity, those are all very, very strong as well. They certainly come off of their peaks given the rise in rates, but still very, very strong flow of inbound interest in our homes."

Beazer Homes – April 28th, 2022

"There continues to be a structural gap between the demand for housing and the total supply of housing. The age and ownership preferences of the demographics are compelling. But there is no practical way for the supply of lots, labor, or materials to meaningfully reduce this gap in the next several years. Second, the level of unsold inventory of both new and used homes is at historically low levels. In fact, there's only 1/4 of the unsold inventory that existed in 2006.”

"The mortgage market is in a very healthy place. The credit quality of the loan book is high, loan-to-value ratios are near historical lows, and importantly, there are almost no adjustable-rate loans with looming pricing resets. So, considering demand, supply, and the mortgage market, we think the multiyear context for new home activity is pretty positive."

M.D.C. Holdings – April 28th, 2022

"Demand was broad based from both a geographic and pricing standpoint as the millennial age buyer continues to be the driving force behind our sales success. This large population of buyers has reached a prime phase in their lives when homeownership became a much higher priority, whether due to changing family dynamics, a chance to build equity or the desire to put down routes. Another driving factor that we have witnessed in our markets is the ongoing migration from high to low-cost areas by both companies and individuals. Factors, including taxes, affordability and overall quality of life are weighing more heavily into where business operates."

"Though we have noticed that the sales process is taking a little longer, most buyer seem to be adjusting to the higher rate environment as well and continue to be motivated to move forward with their purchase. Additionally, we have seen very little change in cancellation rates among our buyers already in backlog. As such, our general sense is that market dynamics remain healthy, and the demand continues to outstrip supply"

D.R. Horton – April 26th, 2022

“We still have more people, qualified buyers, trying to buy homes than we can produce today. One of the things that really has impressed me is back in 2018 when you saw a rapid rise in rates, demand was significantly reduced. And then after the rate shock was kind of mitigated, we saw demand come back and come back strong. But through this cycle, which is an even more rapid rate increase, yes, we've had people that don't qualify anymore, but the demand side is still very strong.”

“We look at a 1% change in our cancellation rate as essentially flat. It's still abnormally low -- historically low. We typically run in the high teens to low 20% and that's a rate we're very comfortable running at... 15%, 16%, 17% wherever it falls out each quarter, really no concerns from us on that end... for those buyers that do unfortunately fall out because they can't qualify, there's no shortage of buyers behind them to take their place.”

Home Depot – April 7th, 2022

“The homeowner's balance sheet has never been healthier, and our consumers and our Pros tell us that their backlogs have never been healthier. So I think that any uncertainty in the short term, there's a counterbalance here, which is just the underlying health of what underpins home improvement demand.”

“What we're really seeing on the demand side and as we think of transactions in units is it's not dissimilar to a storm environment... particularly in Pro-oriented categories, when we receive the goods and get them on our shelves, they go.”

“We just don't think it's very sensitive [home improvement spend relative to interest rates] …. all this home activity, regardless of interest rates, seems to be feeding into remodeling more than it ever has. If I can't find a home, chances are I'm going to remodel. Again, my balance sheet has never been healthier. And so our customers tell us, "Hey, you know what? I can't move right now. And so I'm not going to, so I'm going to remodel. Because I know that I will recoup a return on whatever investment it is I put in my home. It's one of the safest investments I can make” … when they do buy a house, they're also more likely to undertake a remodeling project. And again, our market is made up of a great number of people for whom interest rates don't mean much. "

Lowe’s – February 23, 2022

“Pro customers say their book of business is more robust than they've ever seen it. They have projects lined out for the balance of this year. Some projects may carry over into '23. And health of that business is very strong.”

"Trends remain favorable, including baby boomers' increasing preference to-age-in-place. And with the extension of remote work for some employees, we're expecting a permanent step-up in repair and maintenance cycle. And as a reminder, 50% of the homes in the U.S. are over 40 years old and will continue to require investments for upkeep and approximately 2/3 of Lowe's annual sales are generated from repair and maintenance activity. Therefore, we're encouraged that the macro environment for home improvement remains very supportive."

"If you go back and historically look at periods of time when interest rates have risen at the same time that we had a really good economic backdrop... The home improvement sector has actually benefited from that... You see that same economic climate in 2022."

"Home improvement oftentimes gets combined with home building relative to interest rates. And obviously, the sectors are entirely different... historical trends show convincingly that high interest rates, combined with other positive macro indicators, do not have a negative impact on home improvement.”

Masco – April 27th, 2022

"International markets, including Europe, remains strong, and customers report continued pent-up demand and a strong backlog of projects"

"Numerous structural factors to housing such as demographics, age of housing stock and how consumers view their homes that will be supportive of increased repair-and-remodel activity even in a rising interest rate environment... 2.7 million more homes will reach the prime remodeling ages of between 20 and 39 years old over the next 3 years."

"We continue to see strong demand really across our main countries of Germany, France, U.K., where we do a significant amount of our volume. And that's continued to be robust. And the consumer traffic, the health of the consumer and our demand patterns continue to be strong."

[on doing an accelerated share repurchase] “it comes down to value creation, right? We've seen the share price retreat a little bit this year.... So because of where we see the share price, the strength we're continuing to see in our business, we think it’s a pretty realistic view as to how we see the repair/remodel market developing even in this rising rate environment. We feel that this is the appropriate time and the right time to put our balance sheet to use to be a little bit more aggressive on share repurchases and further enhance shareholder value. We've always said that our share repurchase program would be programmatic. But we always said that we would be opportunistic if we saw a little bit of a dislocation. And we think this is one of those times."

"As we've consistently said through this call and last quarter, demand remained solid and strong. And that is broad-based across our geographies, across our channels and across, as we talked about with regards to mix, our price points.”

“Our backlogs remain strong, international markets are performing well, backlogs at 30 weeks, Pro paint is doing extremely well.”

“The home price appreciation, the consumers' balance sheet, all those things really are, we would call, cyclical factors that are tailwinds to us. And then you add on to that the structural factors around age of the housing stock and the millennials coming into the market. We think this is set up for a very strong several years of demand for us. So we're looking good through '22, and we like the backdrop."

Sherwin Williams – April 26th, 2022

"We continue to see very strong demand in North America pro architectural end markets"

"Rising mortgage rates have not made an appreciable dent in the demand for our new residential customers to this point. Should new residential demand slow, we remain extremely well positioned in multiple architectural segments, including residential repaint and property management, which have proven to be more defensive in nature. We expect industrial demand will remain strong as the year progresses based on the outlook our customers have shared with us."

"Within residential repaint I’ll tell you that our customers are experiencing really strong backlogs. There's a positive mix shift in quality that's also taking place"

"You would clearly see home appreciation driving demand. LIRA, the forecasting for the growth in 2022 is in double digits."

"If you look at the NAHB remodeling index, it is strong, well above 50. And existing home sales have slowed year-over-year against a very strong comp and lack of inventory. But overall, it's a very strong market for us. So we expect to continue to see a good strong demand market in residential repaint from what our contractors are telling us. As I mentioned, many of them are looking through the end of the year with a pretty solid backlog of projects"

"Commercial, I would say the underlying demand here is also solid. Projects are resuming, albeit at varying paces, but the starts are positive… Dodge Momentum Index here is strong, as is the Architectural Billing Index, which has been positive for straight months. And as you know, that tracks the current billing by architects, which generally leads to the commercial construction spending 9 to 12 months out."

"Property maintenance is -- really, underlying demand is solid here as well. There's been delayed maintenance that's now being addressed, and we see improved areas in apartment turns, along with a return to travel, office, even school that's driving demand."

Mohawk – April 29th, 2022

“Market conditions for flooring remain favorable, even as governments raise interest rates to combat inflation. Employment is at high levels and wages are increasing in most of our markets. Millions of millennials in their late 20s and early 30s are forming households and desire home ownership. Unlike past cycles, U.S. housing inventory is historically low, more single-family homes are under construction and the U.S. home deficit will require years to align supply with demand. Remodeling should remain strong with rising home equity and buyers of existing homes still completing long-term projects that they initiated over the past few years. Commercial new construction and remodeling continue to strengthen as business conditions improve and projects that were delayed due to the pandemic are initiated."

Owens Corning – April 27th, 2022

“We continue to see high demand in our key geographies and building and construction end markets. Residential remodeling and new construction in both the U.S. and Europe remain robust, and we continue to see strong backlogs for our commercial construction products, including renewable energy and infrastructure… from a demand perspective in the second quarter, we expect U.S. residential and commercial markets as well as our global building and construction end markets to remain strong."

“In terms of our backlogs and our demand profile, we continue to see really favorable demand trends throughout our Insulation business on both the residential and commercial and technical side… So we continue to run on extended cycles in a lot of those product lines… we think that's going to continue into the foreseeable future.”

“Housing has been underbuilt in the United States for the last decade. So we think there's a lot of catch-up that needs to take place. And we continue to see, even with these high starts, completion rates lagging. So we think there's a lot of tailwinds inside of the U.S. residential insulation business to carry us through for quite a while even in this rising rate environment.”

Hayward – April 28th, 2022

"What we're seeing right now is… continued new [pool] construction permitting into '23. We continue to see builders talk about strong backlogs."

"We're still seeing robust demand and the order file on the books is still very strong and seems to be pressure tested, and product is going to be installed in the backyard."

"What we're hearing is still a really strong book for 2022. Most builders are quoting out into 2023."

Whirlpool – April 26th, 2022

"Demand is strong, very strong. Demand outstrips supply be a wide margin and that has been going on for several quarters"

"We don't see it going away. Replacement is strong and housing will also be strong."

"Demand remains at sustained strong levels and all indicators point to multiyear growth beyond these levels… This is, in large part, due to the fact that housing [construction] remained well below historical and structurally needed levels for over a decade. This is still the case today, which we are seeing play out with housing demand that is constrained by supply... We see demand as even further room to grow. In summary, we remain unwavering in our confidence in multiyear demand expansion in North America."

"In all honesty, I don't see where you see the uncertainty of demand. I said earlier, the demand clearly and has for the last 2 years outstripped supply by a wide margin… our outlook on the fundamental long-term consumer trends in North America are as bullish as we've ever been. So honestly, I just don't see that slowing down. Also on the housing side, I know we're just talking about mortgages, if you look at the fundamental demographic trends, the age of the housing stock, the demand out there, I wouldn't bet against U.S. housing. And we're certainly very optimistic about the long-term U.S. housing trends."

Conclusion

While these operators remain quite optimistic, this isn’t to say everything is perfect, as we have yet to come across a single management team that doesn’t mention inflation and supply chain problems as limiting factors and serious, albeit currently manageable, concerns. But as you can see from the commentary above, demand and backlogs continue to be historically strong with management teams confident in their lines of sight to continued strong demand.

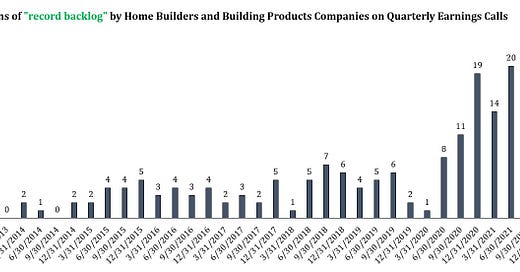

We couldn’t leave you without one chart, so below we show the number of times “record backlog” was mentioned on earnings calls by U.S. homebuilders and building products companies from 2012 - Q1 2022.

In our next article we will look in depth at housing affordability, a timely and key debate within housing.

Where can we see the number of mentions of backlog in earnings calls from year 2000 through 2012? Wouldn't it be instructive to see how these mentions fell into a pattern before and after the great housing crash in 2008?