PAR’s Path to $80 Redux

Godot Finally Arrives

Elevator Pitch

We believe PAR Technology Corporation (PAR) is worth more than $80/share today based on our expectation of margin expansion and growth acceleration becoming evident in the next couple of quarters, combined with the scaling of acquisitions that are both profitable and strategic while also expanding PAR’s total addressable market (TAM). Software platform winners with large TAMs, low churn and concurrently accelerating revenue growth and rising margins at scale deserve to be valued at premium multiples and we believe PAR is at a tipping point in demonstrating all those things. Our $84 base case price target is based on 27x 2026 EBITDA and 5.5x EV/Sales—which is a conservative discount to other vertical, scaled software platform winners.

Key Thesis Points:

Accelerating organic ARR from large new wins and rapidly expanding ARPU

Significantly expanding margins from underappreciated cost discipline

Profitable and strategic M&A expands TAM while strengthening software platform

Divestiture of Government (finally) creates a pureplay

Gigantic RFP pipeline of large Tier 1 QSR restaurant chains

Competition at an all-time relative low

Introduction

We exited PAR Technologies throughout 2021 after years of it being a core long when it became apparent to us that the true growth and profitability inflection was going to take much longer than we had originally anticipated and buyside expectations got way ahead of themselves. While we loved newly appointed CEO Savneet Singh (whom we pushed to get appointed to the board in 2018), we knew he was a very long-term thinker and was making investment/capital allocation decisions that would position the company ten years out, not one or two, and yet an immediate operational inflection point had already been more than priced into the stock.

With each passing quarter we were hopeful we would see signs of a growth/profitability inflection, yet each quarter there seemed to be some new issue that delayed that inflection. First there was a ton of R&D debt that had to be cleaned up to make customers happier. Then there were acquisitions that added upfront costs which obscured underlying progress (most recently the MENU acquisition). Following that, there were seemingly some delays in getting growth drivers off the ground (Payments and Table Service). A bizarre legacy contract with Arby’s involving an ARR stepdown had also obfuscated growth. In all cases it seemed like there was a strong pipeline of large new wins just waiting to be realized, along with costs stabilizing, but it just was not quite showing up on the P&L, and there were no tangible customer wins to latch onto. PAR’s big inflection was like “waiting for Godot”--it was always just around the corner.

We believe the wait is finally nearing an end and there are several significant tangible signs that the long-awaited upward inflection is about to occur. This inflection may begin in conjunction with the beginning of the Burger King rollout, which we believe starts in earnest in Q2 of 2024 and continues through mid-2026. However, there are several additional positive catalysts of note between now and then.

Over the next year we believe the company will simplify operationally (by selling their unrelated Government business, finally), revenue/ARR growth will begin to accelerate on the back of known contract wins (Burger King and others), and significant upfront investments will be harvested to show burgeoning margin expansion. In this scenario we would get “Voss Sauce™” - accelerating revenue growth with concurrent rising margins - which usually leads to valuation multiple expansion, particularly when a company is going from unprofitable to profitable. Pair that with the recently announced acquisitions of Stuzo and Task, and we believe you will have a more fully scaled, profitable pure-play company emerging that will begin getting the valuation credit that enterprise pure-play software companies like AGYS, APPF, MANH, GWRE, TYL, and others currently enjoy.

The competitive landscape is starting to get weaker just as demand gets stronger. In our view, competitive risks are now at an all-time low with Toast losing their largest customer (Jamba Juice) and Oracle/NCR still struggling, providing a bit of a tipping point whereby PAR could be a “winner take most.” This coincides with larger restaurant chains considering moving away from “do it yourself” POS and many other Tier 1s realizing they desperately need to upgrade their technological infrastructure. In other words, competition is weaker, and demand is stronger. Additional burgeoning growth drivers for PAR like Table Service, Payment attach rates, and the long-hyped international expansion should further add building blocks of credibility to justify a premium multiple.

Obvious trading comp Agilysys (AGYS), which has a similar revenue base and does what PAR does but for hotels, trades at 8x sales, 12x Gross Profit, and 45x NTM EBITDA (~34x 2026 EBITDA). We believe PAR’s profile over the next 12-18 months will make them look much more like AGYS (15% EBITDA margins with 20%+ sales growth), and thus the stock could garner a similar multiple (this can be corroborated with other similar companies like APPF, TYL, etc.). In a Bull Case, PAR actually looks far more attractive than AGYS as instead of one giant customer win (Marriott for AGYS), PAR could likely be talking about several (Burger King, Popeye’s?, Wendy’s?, Chipotle? Subway?).

PAR’s path to $80+ is straightforward to us. We derive it by forecasting $125 million in EBITDA in 2026 with a 27x EBITDA multiple, based on adding $138 million in ARR (25.5% CAGR) organically with ~60% incremental margins based on well telegraphed expense discipline combined with the EBITDA from the two recently announced acquisitions. This EBITDA multiple implies around an 8x ARR multiple, a 5.5x sales multiple and 10x EV/gross profit, still materially below the comp group.

PAR’s Business and Competition

For those new to the story, PAR’s primary business is selling hardware and software to restaurants, specifically Point of Sale (POS). To further segment their focus, they have historically been most active in large, enterprise level accounts in the “Quick Service Restaurant” (QSR) or “fast casual” space, selling their hardware to McDonald’s, Yum! Brands, and many others for over 40 years now. Over the past five years they have begun winning large software customers as well, first winning Five Guys Burgers, then Arby’s and Dairy Queen, and most recently, a full mandate for Burger King. In addition to that, they also have a “who’s who” list of the fastest growing fast casual chains like Cava (350 locations), Sweet Green (1,000), Scooter’s (800), and MOD (500). They are winning both the largest “dinosaur” restaurant customers (who are durable and counter-cyclical) but also the fast growing, cutting edge, next generation restaurant leaders.

This compares to VC-funded competitors like Toast, Revel, Clover, and other players like Square and ShiftFour who focus on the SMB space and have more of a Table Service (e.g. Chili’s or your local Italian restaurant) focus. These competitors are different from PAR as they often try to anchor a lot of their economics to payments processing rather than outright software sales. It is challenging to move upmarket with this model because it’s much easier to charge higher payment rates to mom-and-pop stores than larger chains who will often negotiate in bulk. We would also argue these players’ ARR is of lower quality and deserving of a lower multiple given higher underlying churn (SMB) and payments models having secular “take rate” and volatility concerns.

Additionally, building an Enterprise level POS software platform that can stay up to date with thousands of stores and have significant menu management, reporting, and inventory management capabilities at the enterprise level requires an additional layer of R&D development. PAR now has a full suite of products that we think more or less makes them a “complete” solution for a restaurant chain:

Brink - the anchor cloud POS product

Data Central- back office (inventory/accounting/analytics)

Punchh - front end loyalty platform

MENU - complimenting Punchh by offering a viable alternative to Olo by supporting online ordering.

They also offer a full payment processing suite but do not force customers onto it (currently only a small percentage of ARR though growing 100%+). For larger fast casual restaurants we do not think PAR has any “holes” in their portfolio at this point, allowing them to deploy R&D resources towards Enterprise Table Service and begin to discuss international deployment to their captive Tier 1 customer base.

With the recently announced Task acquisition, they now have a credible international product they can begin positioning to their large North American Tier one players. Task is already being used by Starbucks in Australia and McDonald’s internationally.

Further, with Stuzo, they have a best of breed product in an adjacent vertical, “C-Stores” (convenience stores) where Punchh was already competing head-to-head.

What’s Changed Since 2021?

As we noted earlier, it’s always seemed like something has held this company back from truly inflecting.

We would cite five tangible things that have either occurred in the last 3-6 months or are being heavily suggested to be imminent, that give us confidence that this inflection is occurring soon. Additionally, we think there are catalysts that will further elucidate these things.

Restaurant Brands International (RBI) and the Tier 1 “Tidal Wave”

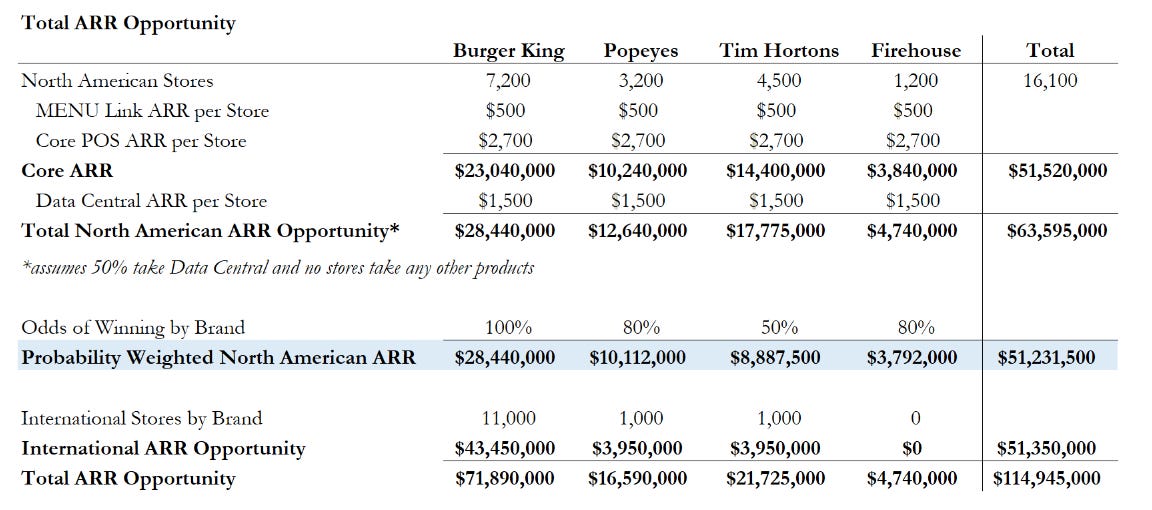

RBI is a large ($40 billion in sales), publicly traded entity (ticker QSR) that represents Burger King, Popeyes, Tim Hortons, and Firehouse Subs. Globally, RBI represents over 30,000 stores in 100 countries, with ~17,000 of the stores in North America.

In early October, Burger King announced an exclusive contract with PAR for all 7,000 United States stores, with a mandate to be rolled out to all stores by April of 2026. It’s our understanding that BK bought not only the core POS (Brink), but also a modified version of their MENU product.

At what we estimate to be an ARR of $3,200/year/store with core POS and MENU, we believe the Burger King North American opportunity alone is worth $22 million in software ARR (total PAR ARR now= $137 mm). This could expand rapidly if they were to add Punchh (~$900/year), Data Central ($1,500/year) or full MENU (MENU link is $500 while full MENU is closer to $1,500).

We also put high odds that Popeyes will become a customer over the next several months. While we have spoken to one individual who believed Popeyes was concerned being “second fiddle” in implementation priority to Burger King, we believe that ultimately RBI leadership will convince them to move to PAR.

Tim Hortons and Firehouse are a little less clear but we believe it’s ultimately the desire of RBI management to bring all their concepts under one POS roof. There may be some “wait and see” approach to make sure Burger King goes smoothly, but ultimately if forced to bet we believe they will get all these chains. Here is a summary of this single opportunity, including if they were to start moving their global base onto PAR:

We believe the North American probability-weighted ARR of $51 mm is a reasonable place to start. On the one hand, they may not win all those customers but on the other, there are additional products that any of these brands could add to that could drive further upside. We will leave international expansion completely off the table despite the Task acquisition and RBI’s desire to have their global base on one master system.

If they were to generate something close to this $50 mm over the next 3 years from RBI, this would be a 37% total ARR uplift from one entity alone. Said another way, this opportunity alone could be nearly half the ARR PAR would need to match our Base Case model assumptions.

The importance of this needs to be explained further. We believe MENU, which competes with Olo, was a material if not decisive reason RBI is pushing PAR. Not only is this a significant shot at a potential long-term competitor, it also suggests the temporary cost pains that PAR went through integrating MENU was almost certainly worth the $18 mm or so they spent on the acquisition.

Finally, a large, mandated win like this, with the pricing it’s getting (not heavily discounted), combined with a quick two year roll out, crystallizes the growth visibility significantly and validates PAR’s standing competitively. Consider that PAR was averaging about 1,100 quarterly installs pre-Burger King. For the next two years, Burger King alone will average 950 stores a quarter, with each store coming in at above average store ARPU.

We think there could be a lot more coming after this. Starting in his Q3 conference call and continuing through Q4 and on the conference circuit recently, we have noticed a significant change in Savneet’s tone, almost in disbelief at the sheer number of opportunities coming to market as seemingly every Tier 1 chain wants to move to the cloud.

Here is a sampling from Q3:

“What makes us even more positive, is that we believe we’re just at the beginning of a tidal wave of large deals coming to market, which should provide for long-term sustainable growth…I’d say just in this quarter we’ve seen more RFPs and interest from the largest brands in the world than we have in my entire time at PAR as it relates to POS. And we also see that in loyalty within Punchh… it seems to have kicked off.”

Then in Q4 in regard to the large QSR brands going through RFPs:

“So I can’t comment, I think, until we announce the press release. But I’d say the number is now more than three, that the pipeline has really gotten far bigger than anything we’ve seen in the past. I think we’ve got- we see three logos that are sort of what we call near-term within our funnel, and then another four that are sort of medium-term. So, the funnel is large and it’s real…POS funnels- RFPs are really robust processes for the customers we work with. Generally, they’re hiring consultants. They spend hundreds of thousands of dollars on consultants, on surveys. And so, when it gets to near-term, the decisions do come because they’ve already spent a ton of money to get to the point of making that decision.”

We spent some time trying to validate some of this, which is difficult. We did speak to a Director of Enterprise Architecture at Inspire Brands, which is a lot like RBI, and owns Arby’s, Baskin Robbins, Buffalo Wild Wings, Jimmy John’s, Sonic, and Dunkin Donuts (>30,000 restaurants) and indicated they were going down a path similar to RBI. We would also note that Roark Capital, the owners of Inspire Brands, recently purchased Subway and their 37,000 global stores. Subway strikes us as a perfect candidate for PAR’s strategy as Subway was attempting to insource their IT but, from our understanding, having many challenges doing so (similar to Burger King). We would expect Roark to outsource as they have with all their other brands. The remaining Inspire Brands are interesting in that currently each of their restaurants is on different competitive POS systems, ranging from NCR Aloha, Oracle Simphony, Infor, and PAR.

The person we spoke with told us their goal was to “have a common POS across all their brands” and that they were in an active RFP with Oracle and PAR being the primary brands they were evaluating. At the time of the interview, they noted they did not have an active CTO and that the new hire would probably have to happen before any decision was made. We then noticed an additional breadcrumb. A former high ranking PAR executive from Data Central left…

And became the Senior VP of Technology Operations at Inspire Brands…

Does this mean PAR is going to win Inspire Brands? No. But it does seem to validate what Savneet is saying, that Tier 1 brands are going through major decision-making processes and that PAR is at or near the top of the RFP process. This provides a credible thesis they will win at least a big share of the deals up for grabs. Winning all of Inspire Brands is not built into our model.

Catalyst: Burger King launch schedule at Q1 earnings, Popeyes/Other Tier 1 wins

Selling of Government

Speaking of waiting for Godot, this bullet has its own special version of that. PAR’s stable, boring, Government services business that churns out ~$8 million in cash flows a year has seemingly been up for sale for 10 years now and was part of our original PAR pitch as early as 2016. It’s been the thesis of many investors (including activists) that selling this business would “unlock” the value in their restaurant business by making PAR a simpler story and more direct transaction/trading comp to other pure plays.

So, after 10 years, why do we think this is happening now?

Here is the language on raising capital in PAR’s 10-Q in May 2023:

And here is the additional language PAR added in its 10-K in February 2024:

On March 11, 2024, at their Task/Stuzo acquisition conference call, Savneet was asked how they would pay for Task, and he responded as follows:

“Given the timeline to close, we expect that we’ll have flexibility on our balance sheet from some of the initiatives we have that we talked about in our 10-K. And I think that’s why we feel comfortable that as we get closer to the point of closing, we’ll be able to hopefully get this done without a meaningful change to our cap structure. So we’re excited that we can potentially sell the majority of that or all of that from our balance sheet moving forward.”

So we now have 1) an official disclosure mentioning the sale of Government and 2) an expected timeline given the closing of the Task acquisition.

A reminder here, Government still represents about a third of revenues and comes in at around 8% gross margins while incremental SaaS revenue should come in at 80-90%+ gross margin. We believe a Government sale would signal to the investment world that the Restaurant business is ready to stand on its own and be a profitable, viable public company without the support of those Government cash flows.

Catalyst: Announcement of Government Sale (anything above $125 mm would be a “win”)

Decline in Competitive Intensity

We took notice when Jamba Juice ditched Toast. This was Toast’s one signature “win” over PAR and left a lingering sense of concern about whether Toast would renew a push up market. With the loss of Jamba Juice, we believe the odds of Toast being an immediate competitor in enterprise fast casual is, well, toast. Although Toast did announce a pilot with Caribou Coffee, and should be watched because of their size, we believe from our discussions with Tier 1 vendors that they are not even making final round RFPs.

Interestingly, it makes us wonder how well Toast will ultimately do in enterprise level Table Service restaurants, which has been their bread and butter at the SMB level. If PAR can begin to penetrate that landscape as well, it would be another clear potential growth driver (note PAR’s recent win with Hooters).

When we look beyond Toast, the competition continues to seem weak to us. Oracle’s Simphony and NCR’s Aloha do compete as legacy players (and Xenial to a lesser extent), but in our eyes have not exactly seized the opportunity within cloud. It’s our understanding that Oracle offered a lower price to try and win Burger King, and Burger King still went with PAR. We just are not seeing new wins or true innovation coming out of these organizations. Perhaps with NCR’s spin-off from their ATM business they become more focused, but frankly they are covering a larger swath of aggregate retail, whereas PAR remains laser focused on food service.

There is one smaller upstart called Qu that has won a couple of enterprise customers and is squarely aimed at PAR’s market. For instance, they won Church’s Chicken. We believe the roll out for Church’s has gone extremely slowly, and that Qu is only winning by aggressive price promotion, not any kind of technological leadership. Additionally, we think many of their “wins” are merely a “hunting license”, not a mandate across franchised chains like PAR is winning. We think their feature set is lacking relative to PAR (e.g. do not have an integrated offering that can compare to PAR) and that their actual ARR is a small fraction of PAR’s. This is all to say that Qu is more of an annoyance right now than a truly disruptive competitor.

We believe PAR will only lose to competitors like Qu and Oracle when the customer is using pricing as their primary evaluation criteria, but that PAR will generally win on focus, customer service, and product quality.

Competition can change quickly (for instance, if Toast bought Olo, that would likely be a negative), so that is something we are watching but for now competition is the weakest it’s been in years at a time when a “tidal wave of RFPs” is flowing like wine with customers instinctively flocking to PAR like the salmon of Capistrano.

Catalysts: Ongoing competitive wins

Margin and Growth Inflection

We believe PAR is about to meaningfully accelerate organic ARR growth coinciding with significant margin expansion, with organic growth potentially moving to 30% as profitability inflects well above zero. This is generally a good recipe for underlying multiple expansion.

A pure comp like Agilysys operates at 15-20% EBITDA margins. It has been apparent their strategy has been significantly more balanced in terms of growth and profitability, compared to PAR’s aggressive spending and cash burn. You can see that PAR has burned a lot of cash over the last few years:

At the beginning of 2023, management drew a line in the sand and said they were going to hold operating costs flat throughout the year. Complications arose immediately because they had to spend millions of extra dollars with MENU to try and win Burger King. This continued the trend of “it’s always something” that gets in the way of a true inflection in profitability.

However, we do think that under the covers, costs have flattened out for a while now.

Here is total R&D (R&D expense + capitalized software costs) by quarter:

And here is non-GAAP SG&A:

Pretty flat.

So, the operating cost structure has held steady even as management notes they have made numerous new investments:

“Without MENU, our R&D expense as a percent of ARR would have been 400 basis points better. But we think we’ll get that investment back in spades…these improvements have been layered on a G&A base that we’re continuing to hold tight on. But what I think is hidden in our results is that we’ve been able to expand gross margin and hold operating expenses near flat, while making a tremendous investment in MENU, ramping head count rapidly for Burger King, and making a larger internal investment into IT systems. These large investments are being made without adding to our operating expenses. We estimate that while OpEx has been nearly flat for the last four quarters, we’ve actually made incremental investments of approximately $9 million in new internal IT, a Burger King ramp up, and the additional MENU investments needed for the US Market, all without adding to our OpEx base.”

So why haven’t things shown up more decisively? Well, I would argue in Q3 and Q4 they started to, while Q1 and Q2 were impacted by a significant impact in MENU test deployments to Burger King and others. Here is Adjusted EBITDA after removing our estimate of Government contributions:

Circled are what we believe are primarily a function of a couple quarters of intensive MENU and Payments infrastructure build out with MENU spend literally done to win Burger King. In Q3 you got a slightly more normalized look before a couple million Burger King expenses hit in Q4. Note, this all impacts the Subscription gross margin line, which is now as depressed as it will ever be and should be on a springboard going forward as ~100% incremental margin revenue starts layering on and some costs rolling off:

Singh reiterated in March, repeatedly, that the margin expansion is coming, likely starting in Q2 at the latest, as MENU and Burger King customers begin to onboard.

“We took the cost basis down there pretty meaningfully just, like I said, two weeks ago because we kind of hit the goals we needed to. As I mentioned, we had our first US go-live with Beef ‘O’ Brady’s two weeks ago…we had our second customer go live today. I’ll talk about that later because it’s not public, but a really impressive 700, 800-store chain. So, it’s coming. And I know it’s been painful, because what kills me is the core business is running so much more efficiently. We haven’t added head count in a long time. It’s the MENU where we have the major loss. And like I said, that’s reversing in 2024 as we have revenue coming on from MENU to offset that impact, plus these cost cuts that I mentioned.”

This theme is something he reiterates again and again, and he has recently started invoking the Rule of 40 as a goal:

“My confidence in our commitment to moving to the Rule of 40 is that we have absorbed the cost of MENU and Burger King in advance of the revenue impact. That will reverse in 2024. This gives me great confidence that there's more to squeeze from our expense base without risking our growth, making the set-up for 2024 exciting.”

Reading through the sell side notes and talking to investors, we believe this depressed margin, along with not having more specifics on Burger King, is why the stock sold off from nearly $50 to $42 over the subsequent weeks. It’s the same “here we go again” that has plagued the stock the last couple of years, but we believe will once and for all start to reverse throughout 2024.

Quibbles aside, we thought Q4 was a low-key blowout quarter from a growth perspective, which gives us a lot more confidence in our 2024-2026 growth forecasts. To start with, let’s look at Brink bookings:

Upon seeing this, our first reaction was, “Oh, they booked a bunch of Burger King stores ahead of the rollout.” Indeed, an analyst asked this exact question on the call:

William Blair Analyst: “Operator Solutions, you had a really good bookings quarter there. I think 3,400 net new site bookings there. Is Burger King in that at all, I guess?”

Savneet: Burger King is almost none of it, like maybe 100 or 150. I mean, it’s all other logos.

William Blair Analyst: Wow. OK.

So even ex-Burger King, this quarter had double the second higher bookings quarter Brink has ever had. Although there may be some end of year deals that do not deploy as quickly as normal, and we do not necessarily expect a blowout deployment quarter in Q1 (our Base Case models under 1,000 a quarter ex-Burger King), this bulging backlog bodes quite well for the coming quarters in terms of ARR growth from Brink. Since Brink is often the gateway to other products, it also bodes well for future cross-sell.

But even within the Q4 installs that did contribute to ARR, there was more encouragement. We look at incremental ARPU of net new stores to determine how pricing is trending, and Q4 again had a massive blowout for incremental ARPU.

This means that, assuming a static base ARPU, the average new store was generating $8,000 in annual ARPU (taking the incremental ARR and comparing to incremental installs). Now we don’t believe the Base was static. We believe pricing increases are beginning to kick in, they have begun monetizing API connections with other products, and Payments revenue is beginning to ramp up. Savneet confirms this, while also saying to expect more of the same in the future:

“It’s about 50/50 Payments and Price uplift, and that’s going to continue. This is the exciting part of the model. The size of the deals we’re in are much larger than before, also at higher ARPU. And so, that’s going to continue. So, we feel really good about the pricing of- Brink as the premium product is getting rewarded for the premium product in deals, and that will continue. But I’d say right now, it’s about 50/50, call it, modules being primarily Payments, but also API monetization, and the other half being pure price increase.”

It’s important to note that their Payments revenue is being recognized on a net basis, not gross, as Olo and Toast recognize it (pre-interchange fees). Thus, Payments revenue, which is doubling currently, comes in at very high incremental margins and will be a margin enhancer (again, looking at Olo you see it’s negatively impacting their gross margins).

Looking at their Operator Solutions segment (Brink + Payments), we are getting 45% ARR growth and that’s before they start onboarding their record high bookings in Q4 or any material number of Burger King stores.

The other major segment, Guest Engagement (which includes their Punchh acquisition plus pending MENU revenue), has been the drag on ARR growth, as shown below:

However, there are compelling reasons to believe it will materially reaccelerate over the next several quarters as well, perhaps closer to 15-20% growth.

MENU is contributing very little revenue thus far but has a large backlog of signed customers that are just now rolling out.

Burger King is using a slimmed down version of MENU (MENU Link) that will be part of every Burger King unit.

The company has called out some large new wins for Punchh (“700-800-unit stores”), some “boomerangs” (churned customers coming back, like Beef O Brady’s), as well as a large Tier 1 Win that at least one other investor believes is Wendy’s. If accurate, this would be 6,500 stores for Punchh that would be nearly a $6 mm ARR contract by our calculations (6,500 stores x $900 annual).

CEO concurs:

“Punchh is growing slower but is really starting to pick up momentum. We announced a bunch of new wins. We’ve got more wins coming this quarter. We haven’t got the revenue for those wins yet. So, Punchh will have an acceleration of growth this year.”

Catalyst: Ongoing acceleration and margin expansion throughout the year; clarification of Burger King rollout

M&A

With Stuzo and Task, we believe PAR has come up with two cash flowing, strategic businesses that open up significant TAM within related markets that also solve some cost headaches. From our diligence so far, both fit their MO of acquiring top end products that are growing and already at Rule of 40. For $400 million in aggregate, they have acquired what we believe will be $100 million in ARR and >$25 million in EBITDA in 2024 on a >20% growth rate (collectively a Rule of 40 acquisition).

To start with Stuzo, it can be thought of as Punchh but geared toward C-Stores (convenience stores). From our due diligence so far, Stuzo seems to be the industry leader, with the most effective competition often coming from Punchh. So now PAR has the top two players in this space, and has large, emerging customers like Chevron, Marathon, Gulf, Circle K, and Delek. This acquisition is attractive for a few different reasons:

Strong growth with strong pipeline: 56% revenue CAGR since 2020 with numerous large customers still in various stages of rolling out their products.

Very strong EBITDA/cash flow dynamics: Off the >$40mm ARR in 2023, they generated $17mm in EBITDA (42.5% EBITDA margins even with limited scale), which as we understand it converts very strongly to FCF (including no stock-based comp).

Strong upsell potential with Brink. We believe the medium-term plan is to modify Brink to fit the Convenience store workflow, and then cross-sell an integrated solution to this segment. As we understand it, the POS in convenience stores is antiquated and ripe for disruption.

Price/Valuation: At $190mm, we think they acquired this business for under 10x 2024 EBITDA. We believe the private equity sellers desperately needed a portfolio “mark” as quickly as possible as they were pushing to raise their next fund and wanted to show a clean exit.

Management Distraction: this may sound counterintuitive, but we believe Punchh’s push into C-stores was a cost headwind and a management distraction, as part of the reason they struggled with their subscription gross margin in Q2 was working through some issues with their largest onboarded C-store customer, Casey’s. Having a more decisive game plan to merge all C-store customers onto the Stuzo platform, with the Stuzo team leading it, may in fact save costs and lower PAR C-suite management distraction.

While we acknowledge some risk of venturing too far from core competency and distracting management, we would note that we believe Stuzo management will be incentivized to stay on (they took equity at a premium to PAR’s recent price) and are highly regarded.

Task is more exciting strategically while still being profitable. Partly owned by McDonald’s before being sold to PAR, we view Task as the company’s international play, acquiring sub-scale but premium technology with large existing Tier 1 relationships (namely McDonald’s and Starbucks). From our preliminary discussions, Task has a very impressive entrepreneurial management team and a very strong collection of products but was still trying to scale. We believe they have an internationally ready POS product, complete with currency calculators and a platform already tested at scale with their international McDonald’s loyalty product. Enter PAR with its growing roster of Tier 1 International QSRs. PAR sums up the opportunity at a recent Needham conference when speaking about RBI international:

“I think if you were Burger King, this is just a guess, they would have been like, oh, gosh, I wish PAR had international. We would have given them all 23,000 stores overnight and we would have made a $100 million contract. And whatever it was, we didn’t have that. We can’t deliver that. I think there’s only so long we can hold off. It also opens up a competitive threat, right? Like what if- one, like our B minus competitors says, hey, we’ve got the perfect international solution. Then somebody says, like I’ll take B minus across everything instead of a A plus and the C over there. Like, I think we’ve got to figure that out.”

We think this is their play to figure it out. Task has been on their radar for “more than two years” because of the marquee relationships, quality of the software, and talented management team. In addition, while not as profitable as Stuzo, Task was starting to scale itself, most recently growing 36% and demonstrating operating leverage by growing operating profits 75%. We believe they will end 2024 at around $50 million of ARR and around $8-$10 million EBITDA, with potentially much larger/faster growth if they are able to cross-sell internationally.

Taking the two acquisitions together, we believe there is a nice mix of strategic fit, growth, profitability, and TAM expansion that accelerates their transformation to looking like larger comps such as AGYS, APPF, and MANH.

Further, we do not think they are done just yet as the acquisition pipeline remains large and point products struggling to scale are trading at reasonable multiples. If the stock can get some momentum, a virtuous cycle can commence whereby they can buy additional under scaled point solutions to beef up areas like Back Office for relatively cheap multiples.

Catalyst: Additional Accretive M&A Announcements, Integration Announcements

Adding it All Up

We have put together a model that incorporates the following:

Underlying ARR growth ex-Burger King/Major Tier 1s of 24% (small acceleration from 2023), then 22% and 19% in 2025-2026.

Burger King adding five points of growth in 2024, six points of growth in 2025, and one point of growth in 2026, with one other major Tier 1 win adding 3 points of growth in 2026 but otherwise no other major Tier 1 wins assumed.

Collectively this produces organic growth of ~26% through 2026 (actual yearly growth rates dependent on the cadence of the Burger King rollout).

4% Core Operating Cost growth from 2024-2026, anchored around finishing 2026 with R&D at 25% of ARR and S&M at 15% of ARR, in line with management’s commentary.

Subscription Gross margins reverting to 73% in 2024 and then expanding to 77% through 2026.

Stuzo and Task growth at an 18% CAGR with very modest operating margin improvement through 2026. We have Task outgrowing Stuzo but are not incorporating any large Tier 1 contracts into our model.

Hardware/Maintenance Service pull through, with modest margin improvement for fixed cost absorption on the hardware side.

No additional M&A.

This produces the framework of the company that management has outlined as they scale into the $300-$400 million ARR range: a company at the Rule of 40 with margins similar to a company like Agilysys at similar scale, something we believe management is laser focused on:

Again, this does not assume a lot of major new Tier 1 wins, nor does it assume much/any success with growing their international business with Task or major uptake in Table Service. Instead, it assumes an ongoing steady pace of ARPU expansion combined with their typical 1,000-1,200 units per quarter installed ex-Burger King. If the company were to land most of Inspire Brands or other Tier 1s in their pipeline, and/or generate material international expansion, revenue/ARR growth could be significantly faster.

What Multiple Should PAR Trade At?

Over the years we have come to appreciate the kind of software company that garners high EV/Sales, Recurring Revenue, and EBITDA multiples, and believe PAR, with this inflection/transformation, will begin to check all these boxes:

Enterprise level customer with very low churn (~5-6% across total business line)

Owns a “mission critical” asset with a full-fledged platform (Brink POS surrounded by apps)

Clear niche industry leader with building operational momentum

Large TAM and long runway for growth

Multiple open-ended growth vectors (Payments doubling, massive new logo pipeline, international expansion, table service expansion, convenience stores, etc.)

Rapidly scaling gross and EBITDA margins

High quality management/CEO with prudent capital allocation and large M&A pipeline

Superior visibility to future growth

Once vertical niche software companies like this hit scale and sustain 25% growth for a couple years with rising margins (e.g. eclipse Rule of 40), they will likely get very nice EBITDA and sales multiples.

For instance, below is a list of companies that roughly fit that description:

We would note PAR’s ARR CAGR will be higher than their total revenue CAGR due to hardware and other services which, while growing, won’t grow at the same pace as ARR.

AGYS is the most obvious comp in our view because it sells POS software/hardware, just in a different industry (hotels and casinos). Also, perhaps akin to PAR winning Burger King, AGYS’s multiple took off when they won Marriott. Finally, they are at a scale that will resemble PAR, and looking to their margin level at similar sizes makes sense, in our view.

Collectively these companies trade on average at ~32x 2026 and ~8x 2026 sales right now, despite only being projected to grow at around 14% and having a middling 63% gross margin.

We believe it is because of their other qualities (churn, industry leadership, pricing power, management) that they attain these multiples, and we see no reason why PAR cannot move closer to that group as their transformation becomes more apparent to the market.

What About Toast and Olo?

We do not think Toast (TOST) or Olo (OLO) are as good comps as the other companies listed above, for different reasons. Toast is payment oriented and is in SMB. Their churn will be consistently higher than PAR’s just from natural restaurant churn, is in much fiercer competition with the likes of Clover, ShiftFOUR, Square, etc. in addition to having lower switching cost than a 1000+ enterprise chain. Second, and more importantly, Toast’s revenue model is primarily payments, which we believe are a lower quality form of revenue than PAR. In addition to being volume based, they are at the whims of a “take rate” for payments that seems likely to squeeze lower in the years to come. And third, Toast is now in a clear deceleration phase of growth. For these three reasons, we believe PAR should ultimately command a significantly higher multiple than Toast as they continue to scale.

That said, Toast trades at 12x NTM gross profit and 58x NTM EBITDA, with heavy stock-based comp, if you want to include them in your comp group.

We view Olo as the Bear Case for PAR. Olo is more of a feature, in our view, than a platform like PAR, as PAR has demonstrated by buying MENU for $18 mm and then winning Burger King on the strength of that product. We believe Olo has material existential risk as a feature to an overall ecosystem, as has been evident with several key customer losses over the last twelve months. Their “growth” is also coming from their Payments initiatives, and they book that revenue gross as opposed to PAR’s net (so at ~25% margins). Revenue growth may look solid for Olo, but gross profit growth is in the single digits and is of lesser quality in our view. Consider this conversation with a Senior IT Exec at Inspire Brands around PAR’s MENU potentially replacing Olo:

Analyst: How has Olo performed for you?

Specialist: Olo is in stores across all of Inspire, so not just Arby’s. It’s basically stable. Nothing special, nothing to write home about, nothing that we’re celebrating but also nothing that we’re complaining about. It just is what it is.

Analyst: What would it take for you to switch from Olo to that product (MENU)?

Specialist: Probably competitive feature set and similar pricing. As I mentioned earlier, Olo is just there. I’m not in love with it, but I don’t hate it. If that MENU product is competitive and I can consolidate vendors, that’s a win.

Analyst: If PAR offered MENU at a lower price, say 10-20% lower, would that be a no-brainer or would it still be a pretty complicated switching process?

Specialist: No, that would basically be a no-brainer.

Analyst: Are the switching costs low?

Specialist: For most of the stuff, yes.

We would note Olo costs around $2,000 a year, while a full MENU product has been coming in at $1,500 a year.

Target Price

We take our Base Case model and apply a 27x 2026 EBITDA multiple. We assume their $45 strike price convertible debt converts to equity while their other debt remains.

This multiple at $84 (>100% upside) would imply 5.5x sales and 8.4x ARR. Based on this framework we would argue PAR is worth this right now but only expect the market to come around as the catalysts described earlier play out over the coming months/years. We are giving a 5-turn EBITDA multiple discount and 2-turns on EV/sales given moderately lower scale/margins to some members of the peer group and because of more challenging execution risk. We would note that with the increased share count from their recent PIPE that we expect trading volumes to improve over time, which generally improves any liquidity discount the company may have.

Bear/Bull Cases

There are clearly numerous execution risks that remain here:

They need to successfully roll out Burger King to validate that they can handle stronger implementation volumes.

They need to avoid that lingering hiccup that delays margin expansion.

Major new competition needs to not emerge.

Stuzo and Task need to roughly maintain their Rule of 40 profile post-acquisition.

Our Bear Case target is predicated on slashing our revenue growth, gross margin, and EBITDA margin forecasts across the board, and giving the company a lowly 3.2x 2026 ARR multiple and 2.2x sales multiple to arrive at $25/share. Essentially, we are comping to Olo, whose total gross profit growth has deteriorated, along with massive stock-based comp expense, low profitability, and a deteriorating strategic position evidenced by the loss of major customers and the lack of a “mission critical” POS infrastructure that PAR has. This valuation would imply a new competitive dynamic emerging that is not currently present in the market and would likely imply some level of challenge of comparable multiple degradation (e.g., software multiples retract).

On the flip side, if PAR starts announcing Popeye’s, other Inspire Brands, Wendy’s, Chipotle, etc. as customer wins, starts getting large new table service wins like Buffalo Wild Wings, or shows success in cross-selling Task to their International Tier 1 base, and becomes dominant within C-stores, our estimates will end up being way too low. These are gigantic, growing markets that we expect to remain durable during recessions and stay relevant in the gig economy. If the flywheel is truly starting to turn as we think, PAR could be a much larger company in the next 3-5 years and in that case our target price can move materially higher, into the mid $100s.

In our Bull Case, the company would achieve a 3-year proforma ARR growth of 28% and get the EBITDA multiple in-line with more high-flying peers, e.g., 35x 2026 EBITDA with a 9x sales multiple and 11.5x ARR multiple. Our case summaries are below:

Please see important disclosures here

this substack, and q2 letter, does not seem to acknowledge something funny happened on the way to $80.

its ok if you have single digit cost basis, otherwise uninspiring effort at updates.

Thank you for this detailed analysis!

Much appreciated if you could explain on the current market share split in the US enterprise-level POS market. How large are legacy competitors in terms of market share, or restaurant coverage?