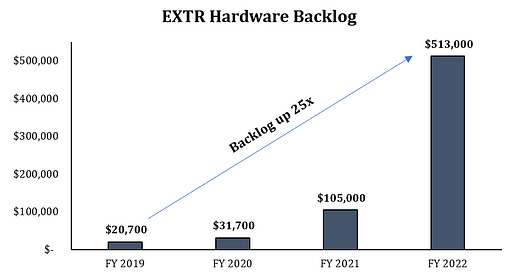

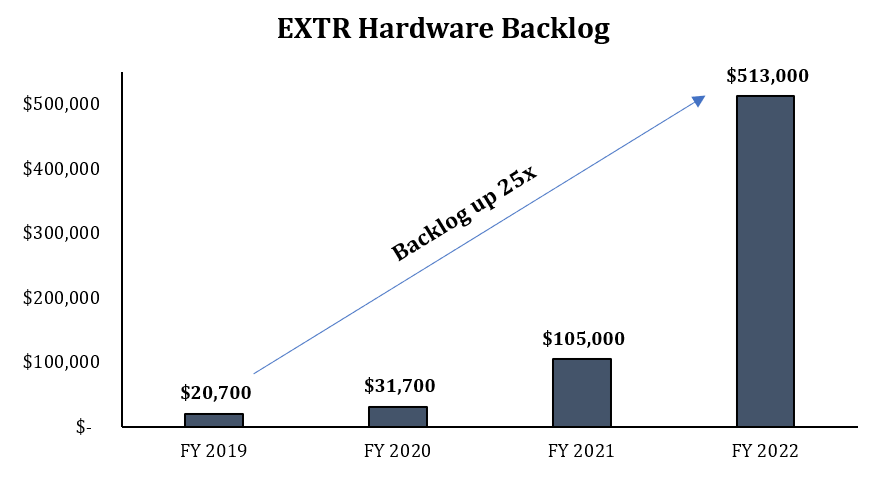

Backlog 25x higher than normal

SaaS revenue growing 40%

Unprecedented visibility to substantial FCF generation over next 3 years

Extreme Networks (EXTR) is now the Voss Value Fund’s third largest position (behind GFF and SWIR). EXTR is a leader in wireless and wired networking equipment (switches, access points, routers), particularly in large scale, complex wi-fi deployments such as hospitals and sprawling university campuses. The Fund has owned EXTR since the middle of 2020 and have previously shared our research on it publicly (see the Voss Q3 2020 Quarterly Letter). At the start of 2020, the company had a >3.0x net leverage ratio and new product orders briefly collapsed around the Covid-related shutdowns. Fast forward to today and leverage is under 1.0x and the shares are even cheaper at 9.5x our next twelve months free cash flow estimate (as of the middle of July), despite their product order backlog being nearly 25x higher than pre-covid levels. In other words, right as its valuation hits a historic low on a free cash flow basis, we believe the company’s visibility has never been higher.

As EXTR’s backlog is realized over the next ~10 quarters, combined with its burgeoning software platform that is just now hitting significant scale (generating >$100 million in recurring revenue while growing 40% year over-year), we believe the company will generate over $750 million in free cash flow over the next three years, which compares favorably to a current market cap of just $1.8 billion and an enterprise value of $1.9 billion. In our view, consensus estimates are far too low for each of the next three years. Even as we heavily discount management’s long-term guidance and assume a slower fiscal 2024 from a bookings (signed contracts) perspective, we get the following profile.

With the stock’s valuation and risk/reward profile arguably much more attractive now than at the time of our first purchases when the stock was $4, why does the opportunity exist? First, to state the obvious, almost all small cap tech stocks have been brutally bludgeoned—dragged down by the non-profitable tech stock bubble bursting.1 Furthermore, from our vantage point the market is suffering from a combination of short-termism and lack of faith in management’s detailed outlook that was presented recently at their analyst day on June 2nd. If the management team is even near the ballpark of executing on their 3-year vision, the stock will be trading at 4x FCF given the enormous amounts of cash we expect to accrue on the balance sheet between now and FY 2025 (ended June 2025).

From discussions with resellers/channel partners and competitors, to attending their user conference and speaking with customers, converging lines of evidence from multiple independent sources support the plausibility that EXTR is taking market share in real-time from Cisco and is poised to show robust growth— even through a hypothetical industry downturn that exceeds the magnitude of 2009’s.

EXTR’s hardware order backlog is typically $20 - $40 million in any given quarter comprised solely of orders that came in near the end of the quarter as they normally ship every order they get immediately. Today that backlog stands at $513 million, and their lead times are the lowest in the industry (certainly ahead of Cisco, who is prioritizing their largest customers). The vast majority of the orders are wanted “as soon as possible.”2

Additionally, it appears management has enough visibility in the sales pipeline and order trends to publicly state they believe the backlog will continue to grow through Fiscal Year 2023:

“Next year, we talked about adding – growing the top line because of releasing supply chain. But we'll still be constrained. So, we'll add another – we expect maybe $150 million, call it in backlog.” -CEO Ed Meyercord, Needham Tech and Media, May 19th, 2022

If that does indeed come to fruition, we estimate the Product backlog would be around $600 million a year from now when their Fiscal 2023 ends. Key to remember is that these are non-cancellable orders.

The backlog going from $105 million to $513 million in FY 2022 means that over the last 12 months EXTR has temporarily foregone over $400 million of high incremental margin revenue that they would have recognized if they weren’t supply constrained. There is also significant service and software revenue tied to this hardware backlog, as customers will sign software deals once the hardware ships. Thus, we estimate these forthcoming hardware sales will provide an additional $75 million in recurring software and services revenue.

By our calculations, if backlog had remained static over the last four quarters, revenue growth would have been > 45% over the past year, rather than the 10% they reported. SaaS subscription revenue, already impressive at $100 million ARR and growing at 40%, would be closer to $150 million. While we don’t expect 45% growth to be sustainable, in our view the company is being valued as a 10% (or lower) grower rather than the market share taker in a positively trending industry with secular growth tailwinds.

The company should also have some additional hardware revenue buffers in FY2024 and 2025 after they work through the current backlog, as they have two major projects with Verizon and Ericsson that could generate an incremental $75-$100 million in revenue a year for several years in a row. And although we are not currently modeling it, we also expect them to continue to take market share from Cisco. This is important because each 1% market share gain is quite impactful to Extreme, i.e., ~$200 million in incremental revenues, and ~$75 million in annual FCF. With our channel checks indicating that Cisco has “all but abandoned” the middle market, we think EXTR has a timely window of opportunity to take more market share.

ExtremeCloud IQ

The second major driver that is increasing visibility is the emergent scaling of the ExtremeCloud IQ platform. Back in 2020, while the company was growing their cloud bookings at a strong pace, it was off a low (and undisclosed) base. The company was moving a lot of their customer base, particularly their wireless equipment base, to subscription contracts. Now, even as the company has passed $100 million in ARR for their Cloud Management software, there are several credible growth drivers that we believe make management’s seemingly aggressive forecast (+40% ARR CAGR 2022-2025) realistic and maybe even conservative. Here are the main drivers as we see them:

Backlog - As mentioned, there is significant Cloud IQ revenue coming from the giant hardware backlog, likely in the range of $50 million of subscription revenue just in the current backlog (in addition to another ~$25 million of annual maintenance revenue).3

Renewals: The most common duration of a subscription contract is three years. Of note, customers were put on “teaser” rates initially, with the expectation that pricing would rise at the time of renewal. The company is just now beginning to enter a period of large potential renewals (really ramping in 3-4 quarters from now as we lap three years for customers who signed in 2020) and expects 90%+ gross customer retention, with net revenue retention moving towards 100%. Given the large discount given initially and the hassle of a “rip and replace,” we think this 100% bar seems attainable and likely conservative.

Copilot/Digital Twin: The company has also been beta testing the “next generation” of features that automates the network in the form of new modules called Copilot and Digital Twin. Copilot adds significant additional features that allows for network automation, while Digital Twin is a cloud oriented solution that allows for more robust, virtualized testing infrastructure. In addition to getting higher base prices on their renewals, EXTR’s sales force will be attempting to upsell these new modules, which carry 50-60% ARPU increases.4

SD-WAN: The company has fully integrated and launched their SD-WAN (software defined wide area network) product into the market that they acquired last year (Ipanema). SD-WAN, when deployed, will carry a very significant uplift to ARPU. It’s our understanding that to hit their growth targets, they need only penetrate about 2% of their 50,000 customers over three years, and only are targeting 250 SD-WAN customers in 2023. This would represent ~20% of their total estimated ARR growth over the next few years.

All four of these drivers seem to be quite significant and it appears reasonable to us that ARR could move from ~$105 million at the end of June 2022 to $250 million by 2025 (matching the midpoint of the 40% CAGR management is guiding to). However, for now we are modeling 34% cloud revenue growth as we are taking what we believe to be a conservative approach on renewals until we see more evidence of solid sales execution.

We would also note in our view that most of the cannibalization in moving some of their software revenue to ExtremeCloud IQ has already occurred. Their software license/maintenance was around $40 million a year and it has now dropped to under $12 million a year, so one will soon see a positive inflection in total Recurring Revenue dollars and thus the stock will likely screen better and potentially begin to attract more growth focused software investors.

Management has said that expedited shipping and elevated freight rates have knocked down product gross margins by an incredible 700-900 bps, and that as freight rates return to earth, they will start to reap the benefits of their significant SKU count reduction and product consolidation onto their Universal Hardware platform.5 However, for the sake of conservatism, we assume hardware gross margins do not rise above 60% vs management’s guidance of 64% as it is possible they have to give back some of their recent price hikes as industry supply constraints ease.

EXTR shares look incredibly attractive on a relative value basis versus its larger networking equipment peers, as well as on an absolute basis at 9.5x our NTM FCF estimates (our FCF estimate is ~50% above the consensus estimate), even after the stock’s recent run from $8.50 to $13.00.

Bear Case: 8x our bear case FCF estimate = $9.00/share (-30% downside). Hence our significant upsizing of the position recently under $9).

Bull Case: 15x our bull case 2025 FCF estimate = $40/share (210% upside).

We take comfort in the fact that in 2008, EXTR’s product revenue grew and in 2009 it declined by only 9.5%.6 Given their product order backlog is currently ~25x the size it was at the end of 2019, we are comfortable that EXTR can grow even through an economic depression. The risks for Extreme mostly revolve around timing and management credibility on forecasts. At times they have been overly optimistic, particularly around forecasts from acquisitions, as well as recently around gross margins. However, if management loses additional credibility and the stock gets stuck in a penalty box, we believe there would be strategic suitors who would be interested in acquiring the company for its customer base and industry-leading cloud technology, along with significant sales and marketing and R&D synergies. Valued at an enterprise value of just 2x gross profit and 9.5x FCF, the risk feels highly asymmetric to the upside.

Disclaimer: https://www.vosscap.com/disclaimer

Average small cap tech stock down by >50% from peak as of mid-July. Source: Factset.

EXTR’s analyst day presentation.

Voss estimates

Discussions with Extreme employees

EXTR CFO during Analyst Day remarks and various public calls.

Extreme’s SEC filings

I like this stock (I have written it up as well), but SBC should really be included in FCF estimates. It is a very real expense.